Did you know that 91% of successful cyberattacks start with a phishing email? Being able to detect and avoid phishing emails that land in your inbox is a key part of strong cybersecurity. To do that, it’s important to be aware of different types of phishing emails and stay attentive to the warning signs in every possible scenario. To help you stay one step ahead, we’ve gathered some examples of the most common phishing emails out there and explain how to identify the telltale signs of a phishing attempt.

Common phishing subject lines

Before we dive in, let's go over these 10 common phishing subject lines. Recognizing these signs can alert you before opening an email, helping you spot potential threats right away.

"Your session expired. Click here to sign in again."

"I need you to make an urgent payment"

"Dear applicant…"

"Due to the current situation…"

"Merry Christmas!"

"We are unable to process your tax return"

"No response required"

"Follow up"

"Payment status"

"Password Check Required Immediately"

10 real phishing email examples

You've probably seen a lot of phishing emails, some are easy to spot, and others are sneakier. Even though we should always be skeptical of emails, that's not always the case for everyone. In fact, 44% of people trust an email just because it looks like it's from a familiar brand.

As you go through these examples, consider if you or your team could spot these phishing attempts or might feel tempted to click on phishing links.

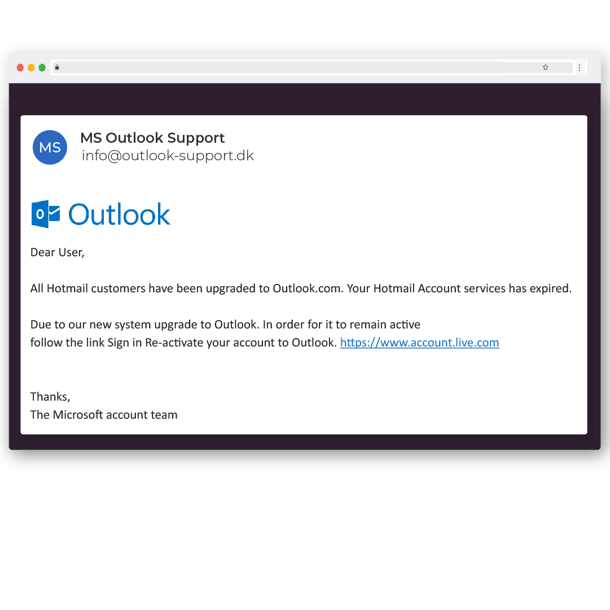

1. Email account upgrade scams

You know those moments when you get a scary email about losing access to your account? Scammers take advantage of that fear all the time. They pretend to be urgent messages from trusted sources like Microsoft, Google, or even your own company's IT department. They lure you in with promises of necessary upgrades or extra storage space, making you feel like you must act fast or risk losing your account.

Scammers want you to click the link and enter your login details on a fake page. Once they grab your info, they lock you out, steal your data, sell it, and target your contacts with more scams. They might also use your account to send out more phishing emails, making it look even more legitimate to your contacts.

2. PayPal scams

PayPal, with its 300 million users, is a magnet for cybercriminals who perceive it as an ideal target due to its direct links to your credit card and bank account. PayPal scams involve various methods scammers use to trick users into sending money, sharing personal information, or granting account access.

Scammers know they have a better chance of deceiving you if they can talk to you on the phone and push you to make a quick decision. This scam email is crafted specifically for that.

But if you stay vigilant, you'll spot the key indicators of a PayPal scam. The PayPal logo appears pixelated, suggesting it was lifted from another website. It tries to create urgency by threatening consequences if you delay. There's a fake phone number included to supposedly cancel a fraudulent order.

3. Fake invoice scams

Fake invoice scams are all about tricking you into paying for stuff that doesn’t exist or charging way too much for real items. These emails might look like real invoices from vendors you know, but the payment details are fake.

Fake invoice scams involve receiving emails that resemble legitimate invoices from familiar companies, often for items or services you haven't purchased. If you pay, the money goes to scammers. Watch out for attachments that could contain malware or links to fake login pages aimed at stealing your information. Always verify invoices directly with the company to avoid falling victim to these types of scams.

4. Google Docs scam

The Google Docs phishing scam starts with an email that seems harmless, often appearing to be from someone you trust—a friend, colleague, or reputable organization. It includes a link to what looks like a shared Google Docs document. However, clicking the link takes you to a fake Google sign-in page designed to steal your login details. Once the scammers have your credentials, they can access your Google account, potentially stealing personal information, sending spam, or even committing identity theft.

Signs of a Google Docs phishing scam include unexpected emails from unknown senders or unusual messages from known contacts, generic greetings like "Dear User," and emails that use urgency or fear tactics to prompt immediate action. Always verify website URLs before entering your credentials to avoid falling victim to phishing attempts.

5. Human Resources (HR) email scams

The surge in HR-related phishing attacks is worrying, showing how cybercriminals are getting smarter. IBM Global Security's 2023 study found that phishing is the top cause of corporate data breaches and one of the most expensive cyber threats.

Phishing emails often exploit HR topics like dress code updates or vacation policies, and they often mimic urgent messages such as IT alerts, service notifications, or tax matters. These emails can emotionally affect employees, who typically trust HR communications and are therefore more vulnerable to falling for phishing scams.

Employees should always double-check and verify any unusual HR requests through official channels they trust. It's important to be cautious with unexpected emails asking for sensitive information, even if they seem to come from someone within the company.

6. Bank scams

Many banks send account updates and security notices to customers by email. Cybercriminals take advantage of this by sending fake emails about account transactions and suspicious activity.

Their goal is to steal sensitive information like your online

banking username, password, and account details.

If you receive an email or text asking for account information, remember that banks and credit unions never request such details through email. If you get this kind of message, it's crucial to contact your bank or credit union right away. Use a customer service number from a different source, not the one provided in the email or text, to report it immediately.

7. Advance-Fee scam

This classic scam is still very common and used often. It promises you a lot of money if you pay a fee upfront. Despite many people thinking everyone knows it's a trick, nearly 400,000 cases are reported each year.

It's important to know the signs of this scam and be careful when shopping online. Even if you're not actively buying anything, scammers can still target you. They might email you saying you've won a lottery, inherited money, or been picked for a grant. But be careful—they'll ask for fees or personal details to 'release' the money they promised you.

Scammers appeal to greed and desperation by promising large sums of money. They often tell elaborate stories and provide fake documents to make the offer seem legitimate. Once you pay the "fees" or provide personal information, the scammers disappear. Look out for too-good-to-be-true offers, requests for upfront payments and suspicious email addresses.

8. Unusual activity scam

These emails warn you about unusual activity on one of your accounts, urging you to verify your identity or reset your password. The provided link leads to a fake login page designed to steal your credentials.

Cybercriminals use fear and urgency to make you act quickly. The email claims there's been suspicious activity on your account and provides a link to a fake login page. Once you enter your credentials, they capture them. Be cautious of alerts about unusual activity, links to fake login pages, generic greetings and requests for sensitive information.

9. Tax refund scams

Cyber criminals pretend to be from tax authorities, claiming you’re eligible for a refund. The email includes a link to a fake tax authority website, where they ask for personal and financial information.

Scammers use the promise of a tax refund to lure you into providing sensitive information. The fake website is designed to look like a legitimate tax authority site. Entering your details there gives the scammers access to your personal and financial information. Watch for unexpected tax refund notifications, requests for personal information via email, links to non-official websites, and emails with poor grammar.

10. CEO phishing emails

Also known as Business Email Compromise (BEC), these emails appear to come from a high-ranking executive, often the CEO, requesting urgent action.

Cybercriminals research your company structure and spoof the CEO’s email address. They send urgent requests to employees, often targeting those in finance or with access to sensitive information. The sense of urgency and authority from the “CEO” can make employees act without double-checking the request. Look out for urgent, unusual requests from executives, emails from slightly altered addresses and pressure to act quickly.

The human element of phishing attacks

All email attacks rely on someone in your business falling for the scam. So, it’s important to create a culture of security within your business to reduce the chances of phishing attacks.

1. Keep security top of mind

Make sure everyone knows the basics of what to look out for, like suspicious emails or links. Regular awareness training can help everyone stay sharp and recognize potential threats before they become a problem.

2. Know what to do

If someone thinks they might have clicked on a phishing email, they should know exactly what to do next. This includes who to tell and what steps to take right away to prevent any damage.

3. Set clear email rules

Have a simple, clear email use policy in place. It should explain how your team should use their work email and why following these guidelines is crucial for keeping everyone safe.

4. Test your team

It’s also a good idea to run phishing simulations from time to time. These fake phishing emails help your team practice spotting scams in a safe environment and can show where more training might be needed.

Building a security-conscious culture

Phishing emails might seem daunting, but with the right knowledge you can significantly reduce their threat. By familiarizing yourself and your team with common phishing tactics and staying vigilant, you’ll be better equipped to spot and avoid these scams. It’s all about making security a daily habit—keeping an eye out for red flags and knowing what steps to take if you suspect an attack.

Creating a culture of security within your organization doesn’t have to be overwhelming. Regular training and clear guidelines can empower everyone to be more cautious and confident in handling suspicious emails.

And if you’re looking for a little extra support, we’re here to help! We handle these challenges every day and are ready to assist you. Plus, take advantage of our free 14-day trial of our awareness training courses. We’ll walk you through common phishing tactics and equip your team with the skills to identify and address potential threats before they escalate.